Attribution modelling is a widely used tool in businesses that helps the marketers to understand the impact of various marketing channels have on the ROI of their businesses. The insights from this simple exercise allows the marketers to track and analyze the multiplied touch points in sales and their impact on the conversion value. This in turn helps the marketers in effective credit allocation of their marketing budget on the various credit channels.

With the behemoth amount of data, digital marketers are now shifting their focus on attribution for the purpose of increasing their conversion rates. Low online conversion is generally overcome by optimized customer service by personalizing customer experience management, web analytics and enhancing the use of feedback. Conversion path analysis is done to convert the normal website visitor to a paying customer or even a subscription to a newsletter may be considered as a conversion. A simple layout of a path conversion is shown as follow:

When the website visitor is on the landing page there is a requirement to enhance his user experience by providing relevant information about the products and by establishing an emotional connection to the brand. To avoid distraction, it is required to provide focused content and targeted conversation and providing highly flexible pages for easy operation by the users.

Conversions generally involve more than one channel and conversions generally travel down the multi-channel funnel.

The channels could be:

-

Paid-search

-

Organic-search

-

Social media

-

Referrals

-

E-mail

-

Direct

For example, one may first read about your product on a blog-post. Then, he may see a display-ad. Later, he may read a review on some website. Curious about your product, he will see your PPC ad. After that, he visits a product comparison website. He then clicks on an organic search result which then reaffirms a customer to buy your product and he finally purchases your product.

In the example, we see that a ‘buyer persona’ visits various channels and finally decides whether he wants to purchase a product or not. A marketer would now want to assign credit to the different channels which assisted directly or indirectly in the conversion process. This set of rules that govern the assignment of credit to the various channels is known as attribution. For this process there are various attribution models available. These are:

-

Offline-Online attribution model: This model determines the impact that the digital marketing channels have on the offline marketing channels and vice-versa. This model understands the influence that digital marketing channels have on the offline marketing channels and how to assign credit to them.

-

Multi-Device attribution model: This model determines the impact that various devices (Laptops, Desktop, Mobiles, Tablets, etc.) have on conversions and how credit is to be assigned for various devices.

-

Multi-Channel attribution model: This model is the most common model that is used in the industry. It studies the effect that various digital marketing channels have on the other for conversions and how the credit is to be assigned for the various channels.

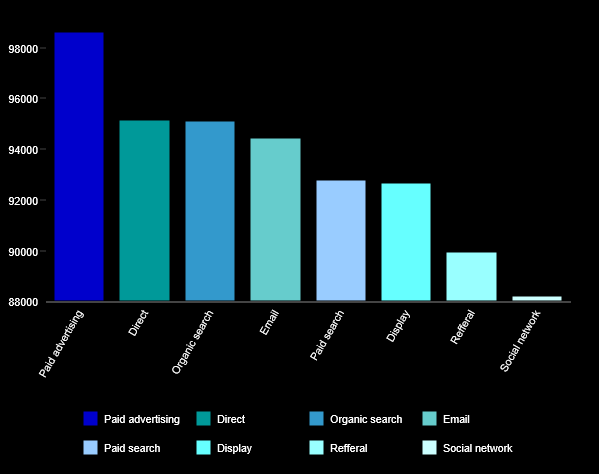

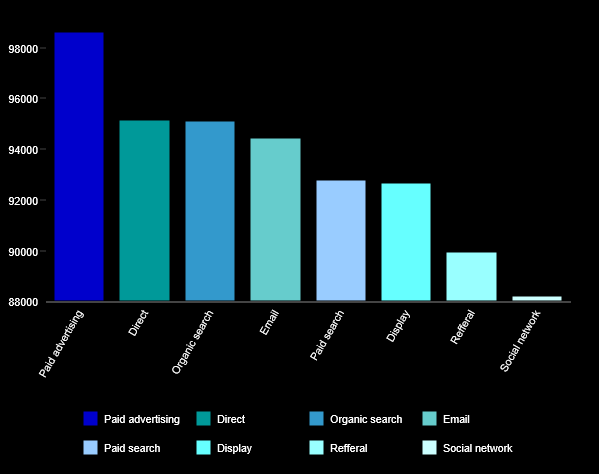

In the case study available here we have tracked and analyzed the various metrics driving to multi-channel attribution modelling that is commonly used in the E-Commerce market. The model also extends further to showcase a data driven hybrid approach to attribution modelling that combines the intelligence of more than one attribution model based on the customer profile to channelize the credit assigned effectively. The outcome of such an exercise would be similar to a plot below which depicts the conversion value attributed from each channel which is used in your conversion path.

The assignment of credit is essential to understand which channel plays a more important role in assisting the conversions. We can determine on which channel we would want to spend more money and time. Thus, at a minimal cost we would be able to improve the efficacy of conversion rate. Thus the attribution model is becoming an integral part in the lives of digital marketers.

The various eTail topics discussed are

The various eTail topics discussed are

Recent Comments