Validating “income levels” based on asset based “wealth indicators”

The income variables received from surveys will typically shows a relatively very high proportion of abnormal values due to insertion of false information, substantially reducing the number of valid cases in multivariate statistical analyses, etc. Such a discrepancyon a key predictor variable like income variable is undesirableas it alters the modeling analysis, insights. In this blog, we shall focus on an effective alternative mechanism to qualify “the wealthiness” of the customers based on their assets.

The survey questionnaires can be effectively constructed to collect information on household assets with the aim of obtaining more precise measures of economic well-being on the largest possible proportion of respondents. Indeed, the non-response or fraud rate associated with the household asset items in the application is much lower than the one for the income variable.

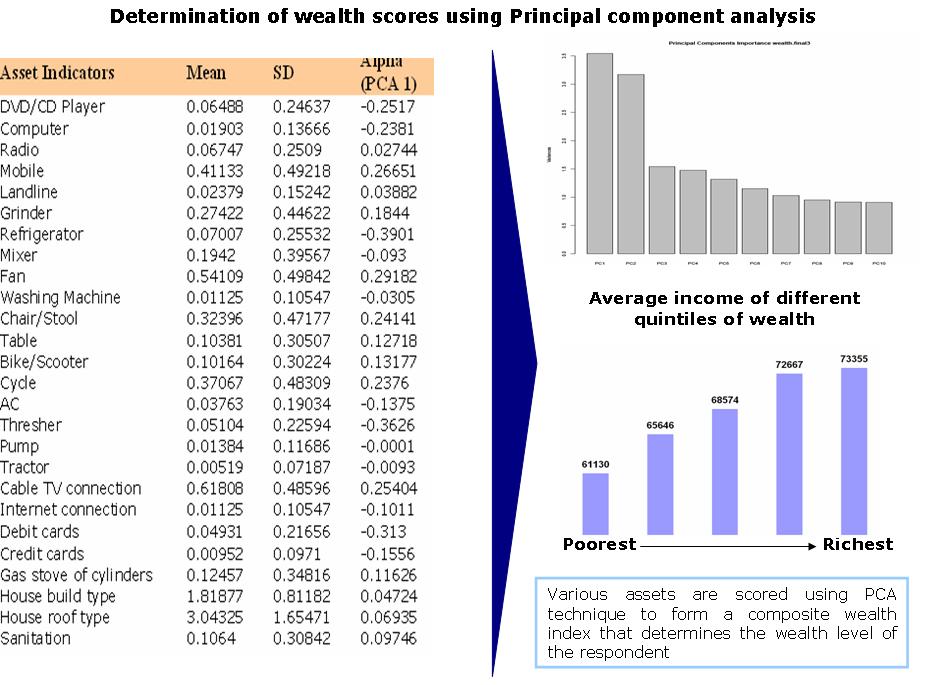

The estimation of relative wealth using Principal Component Analysis (PCA) is based on the first principal component. Formally, the wealth index for household is the linear combination, the first principal component variable across households or individuals has a mean of zero and a variance of λ , which corresponds to the largest eigenvalue of the correlation matrix of x .

The first principal component y yields a wealth index that assigns a larger weight to assets that vary the most across households so that an asset found in all households is given a weight of zero . The first principal component or wealth index can take positive as well as negative values. PCA analysis was performed on the asset information collected from the respondents. Each applicant was scored from 1 to 5 based on the computed wealth indices. The score 1 denotes the bottom 20 % or otherwise the poorest of our applicants. Similarly the top 20 % were denoted by the score 5 who were our richest applicants. use of PCA for estimating wealth levels using asset indicators to replace income or consumption data. A relative wealth index was computed using the methodology described based on the following items asked in the survey:

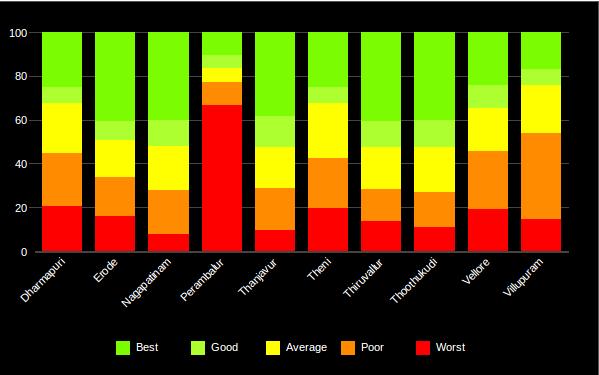

The above exhibit is the normalized representation of the data. The analysts can now calculate the calculate principal component loading value that can be used as effective wealth indicators. The below exhibit qualifies the effectiveness of these indicators on the income level. The plot showcases the wealth index computed for the individuals who have undergone the survey at household level. Based on the wealth indicator computed from the asset analysis of the individuals, they have been scored and ranked as “Poorest”,”Poor”,”Average”, “Good” and “Richest”.Do note that the average income level rises as we scale to higher wealth indicator groups. This technique not only validates the income levels but also provides an alternative powerful variable for statistical analysis.

Click here to view a case study demonstration on Validating “income levels” based on asset based “wealth indicators”.

Recent Comments